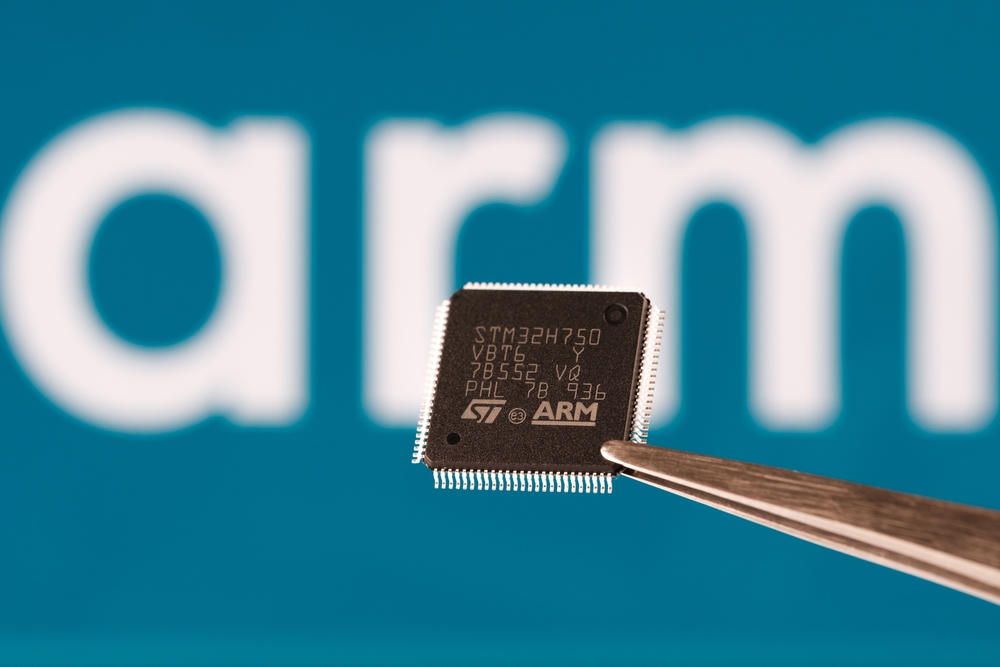

If you haven't heard of Arm Holdings (ARM), a giant British chipmaker, you certainly have heard of the companies that it is helping to power.

Consider that its intellectual property is used by Amazon, Microsoft, Samsung, Qualcomm and Apple’s newly released iPhone 16. Oh, and also Nvidia, the biggest semiconductor company in the world.

The way it works is that Arm will normally license its chip blueprints out to these companies and they customize them out for their own needs. Arm will then collect royalties from each chip that’s been made using its IP.

The vast adoption of its technology has made ARM “one of the most dominant semiconductor chip designers on the planet,” according to Morningstar.

In a note released in November, Loop Capital analyst Anandah Baruah raised his price target for ARM to $180 from $130, citing this broad adoption.

“Our biggest takeaways is that ARM is going to continue to have multifaceted pathways to increasing momentum the next few years in Smartphones (30% - 40% of revenue), Data Center (moving to 10% - 15% of revenue) and very potentially PCs (small to potentially material),” he wrote.

The company, which is 90% owned by Japanese investment holding company SoftBank, has seen its stock surge by 155% since it went public in September 2023.

Arm got another boost in January when it was announced as a partner in President Trump’s joint Stargate venture with OpenAI, Oracle and SoftBank to build AI infrastructure in the U.S.

New business plan brings in another big-name partner, challenges its clients?

Although Arm’s business model of licensing out its IP to other companies to customize their own chips has been successful, the Financial Times reported in February that it would begin making its own chips in-house this year.

And according to the FT, the company has already landed Meta as its first enterprise customer. Arm is expected to release its first in-house built chip this summer.

Arm’s shares rose 6% following the announcement to $164.83. It was trading at $132.06 on Thursday, as a recent selloff has brought down most AI stocks. What’s interesting about this new strategy of building chips in-house is that it will turn some of its customers into competitors, as TechCrunch noted.

Nvidia revealed in its recent 13F file that it cut its stake in Arm by nearly 44%. However, the company still owns 1.1 million shares of Arm valued at about $181 million.

In 2020, Arm agreed to be acquired by Nvidia for $40 billion, but the deal fell through when the U.S. Federal Trade Commission sued to block it, saying that the deal would stifle competition among rival chipmakers.

Semi demand to explode in 2025

In its 2025 global outlook report on the semiconductor industry, Deloitte analysts estimated sales this year to be $675 billion, eclipsing the $627 billion in sales from 2024.

It could reach $2 trillion in 2040 if it continues to grow at a 7.5% compound annual growth rate, according to Deloitte.

The report also notes that as of mid-December 2024, the combined market capitalization of the top 10 global chip companies was $6.5 trillion, up 93% from $3.4 trillion in mid-December 2023.

As Arm shifts its strategy this year into making its own chips, investors will likely be watching to see how much of this market share it can grab, especially as some of its customers now become its rivals.

Your email address will not be published. Required fields are markedmarked