Super Micro Computer (SMCI) took a hit in Wednesday’s after-hours trading, closing at $39.20—nearly 10% off the day's high—despite an upbeat earnings report.

The company’s preliminary Q2 results reaffirm strong AI-driven growth, but a downward revision to full-year guidance tempered investor enthusiasm.

Super Micro expects Q2 revenue between $5.6 billion and $5.7 billion—a 54% year-over-year increase at the midpoint. However, full-year revenue guidance was revised down to $23.5 billion to $25 billion, from a prior forecast of $26 billion to $30 billion.

Despite the downward revision, 2026 guidance stole the spotlight.

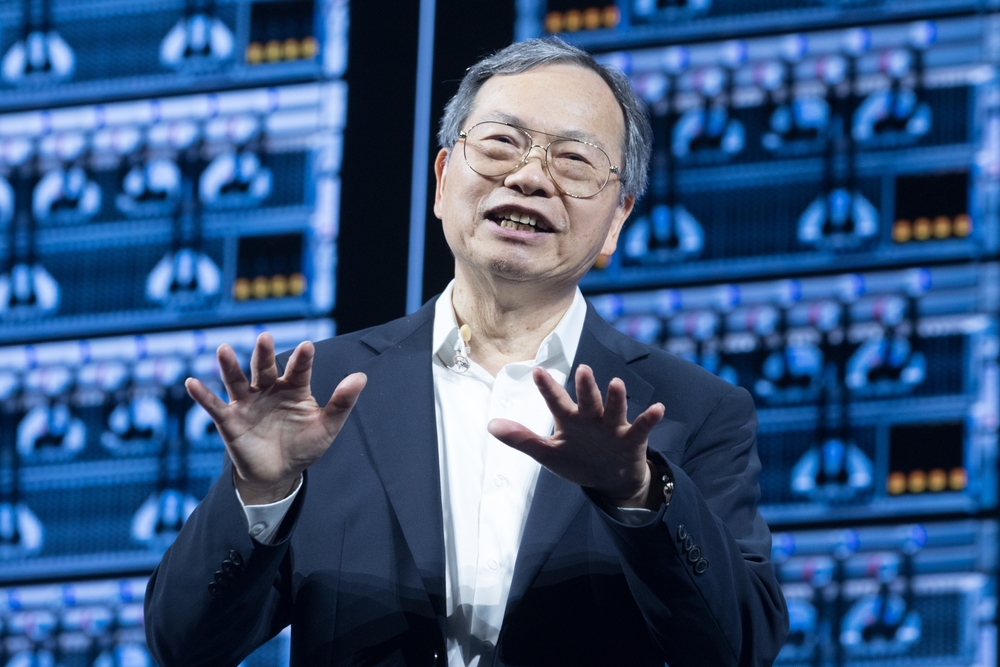

The company projects $40 billion in revenue, well ahead of analysts' $30 billion estimate. CEO Charles Liang called the target “very conservative” during the earnings call.

AI Demand fuels growth

The ongoing AI boom remains Super Micro’s primary business drivers.

The company builds AI hardware leveraging Nvidia’s (NVDA) GPUs, with growth fueled by its 4.0 initiatives—data center building block solutions (DCBBS). These include integrated server racks, storage, networking, software management, and liquid cooling, offering a 40% lower total cost of ownership.

Liang emphasized Super Micro’s leadership in AI infrastructure:

“Supermicro’s NVIDIA Blackwell GPU offerings in plug-and-play scalable units with advanced liquid and air cooling empower customers to deploy AI infrastructure with exceptional efficiency. This reinforces our commitment to sustainable, cutting-edge solutions that accelerate AI innovation.”

The company has already begun shipping NVIDIA Blackwell products and expects over 30% of new data centers to adopt liquid cooling this year.

Meanwhile, tech giants like Meta, Amazon, Alphabet, and Microsoft plan to pour a combined $320 billion into AI and data center expansion in 2025—bolstering demand for Super Micro’s hardware.

SMCI bulls hold their ground

Super Micro stock has surged 24.2% over the past five sessions, outperforming the S&P 500 (-0.3%) and the Nasdaq (-0.4%). It’s up 32.5% year-to-date, and analysts say the rally may be far from over.

Following the earnings report, Lynx Equity Strategy set a $60 price target, citing revenue growth potential, competitive positioning, and strong cash management.

“With renewed access to capital markets, plenty of manufacturing capacity available, leadership in deploying liquid cooled NVDA racks at scale, we think SMCI is poised for upside surprises," the firm wrote in a note.

Lynx Equity Strategy added: “The surprisingly strong $40 billion revenue outlook he provided for FY26 may be a conservative estimate."

Your email address will not be published. Required fields are markedmarked