Fund managers are backing away from the U.S. dollar — and, by extension, dollar-denominated assets — signaling that the currency’s slide may reflect something bigger than short-term swings.

According to Bank of America’s June 2025 Global Fund Manager Survey, a net 31% of respondents were underweight the dollar, the most negative reading since January 2005.

Put another way, fund managers are the most bearish on the U.S. dollar in 20 years.

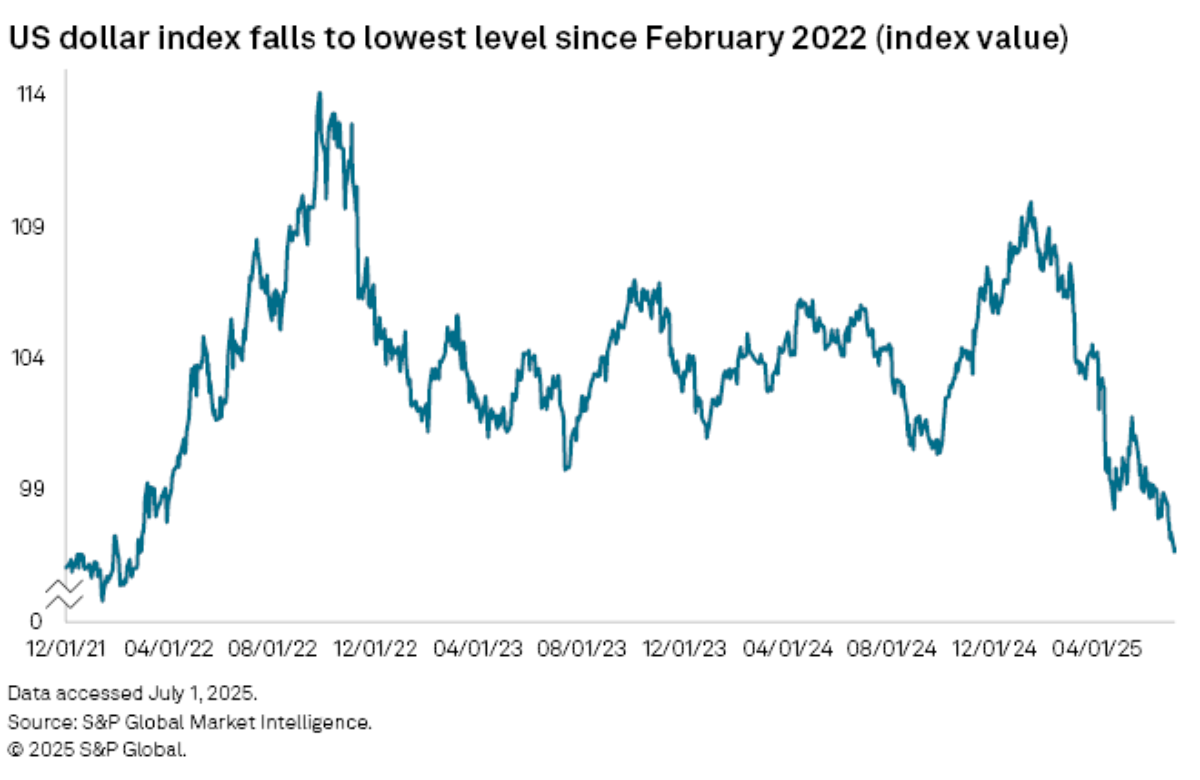

That shift in sentiment coincides with a steep drop in the U.S. Dollar Index (DXY), which fell nearly 11% in the first half of 2025, its worst six-month stretch since 1973, according to S&P Global.

Even with a modest rebound in recent weeks, the dollar remains down nearly 10% year-to-date.

“The trigger for the move may have been uncertainties over the policy outlook, on trade in particular, but also the erratic nature of policy formation itself,” said Derek Halpenny, managing director and head of research at MUFG Bank.

The survey results also hint at larger questions about the dollar’s future role as the world’s default safe-haven.

Rising protectionism, a growing deficit, and geopolitical uncertainty are prompting more fund managers to reconsider the long-standing dominance and, more importantly, safety of U.S. assets.

“If global capital flows into U.S. assets dwindle, it could point toward a more multipolar world with a diminished reliance on a singular reserve currency,” wrote PIMCO’s Marc Seidner and Pramol Dhawan.

“Sell America”? Not so fast.

While the dollar and Treasury market have been flashing warning signs for months, appetite for other U.S. assets remains intact.

In fact, some parts of the U.S. financial system are proving remarkably resilient. U.S. stocks have staged a historic rebound, rising more than 30% from April lows to reclaim record territory.

Corporate earnings are driving the rally. According to FactSet, S&P 500 companies are on track to post 10% year-over-year earnings growth in Q2, with revenues expected to climb 6%.

And despite the tariff war and political uncertainty, foreign investors don’t appear to be fleeing.

In a June note, Morgan Stanley strategists said they saw little evidence “to support the narrative that foreign investors have been reallocating away from U.S. stocks.”

That suggests confidence in U.S. equities, even if the dollar’s dominance is starting to fray.

Your email address will not be published. Required fields are markedmarked