Australia’s lithium stocks had a tough start to 2024 due to a temporary lithium oversupply and falling commodity prices.

Despite these short-term hurdles, the lithium industry is likely still in the early stages of its boom.

As the global economy shifts from fossil fuels to electric and hybrid vehicles, analysts predict a multi-fold growth in the demand for lithium and other cleaner energy resources.

Australia plays a crucial role in the global lithium market, thanks to its vast reserves of this critical mineral and its well-established infrastructure.

With the surging demand for lithium-powered energy, Australian lithium companies are positioned to be among the biggest winners.

In this article, we've compiled a list of the top lithium stocks, including lithium refining stocks and lithium mining companies, on the Australian Stock Exchange (ASX).

Each of these companies has flexible production capacity, sufficient capital to handle fluctuations in demand, and long-term contracts with battery and EV manufacturers, ensuring stable cash flows.

Comparing the best Australian lithium stocks

The following is a shortlist of 10 ASX-listed Australian lithium mining companies that are worth watching.

| Company | Stock symbol | Market cap | YTD returns |

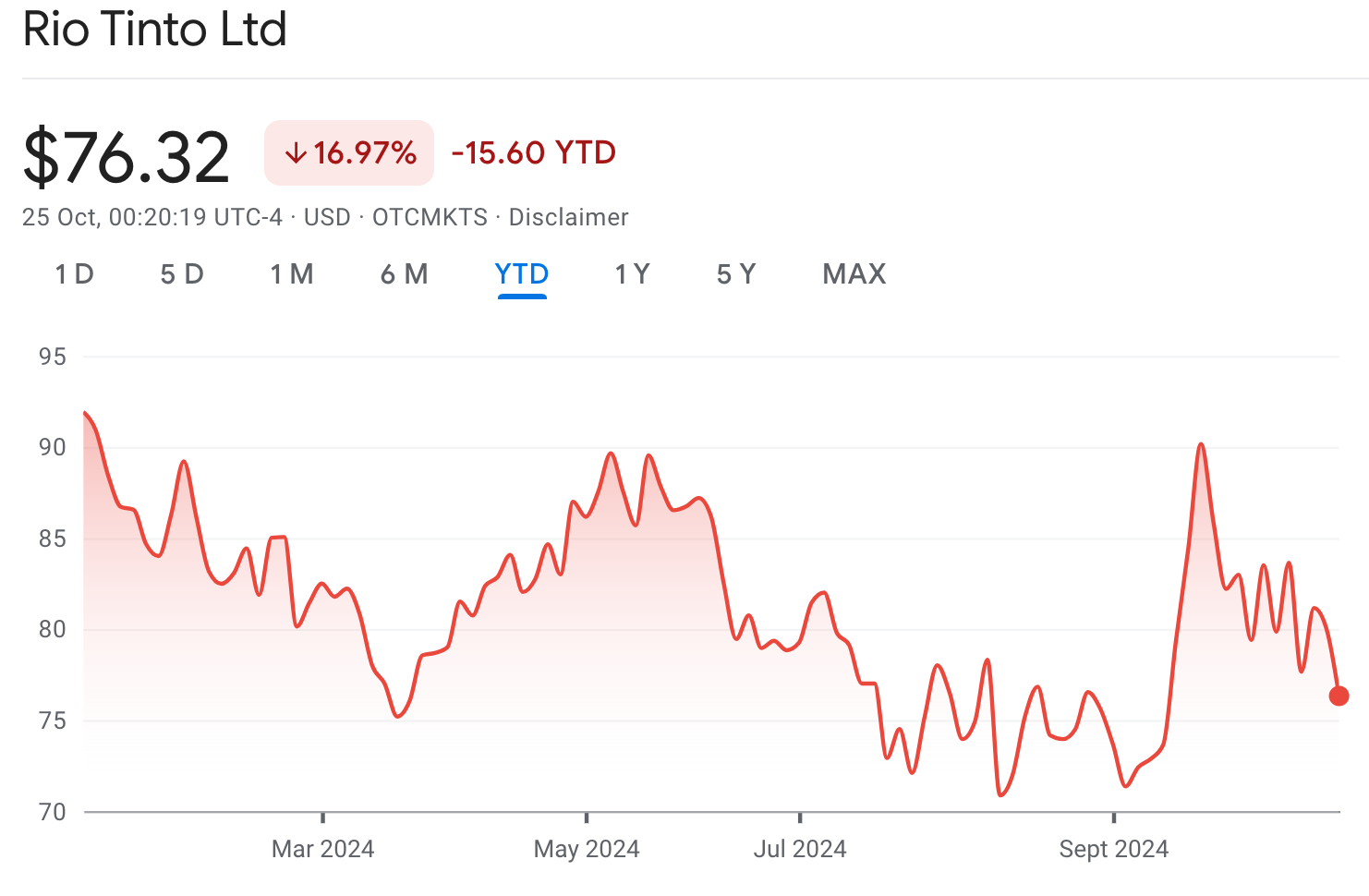

| Rio Tinto Ltd | RIO | $104 billion | -13.7% |

| Pilbara Minerals Ltd | PLS | $8.19 billion | -31.1% |

| Mineral Resources Ltd | MIN | 7.07 billion | -48.6% |

| Arcadium Lithium plc | ALTM | $5.94 billion | -26% |

| IGO Ltd | IGO | $3.88 billion | -43.3% |

| Liontown Resources Ltd | LTR | $2.02 billion | -49.4% |

| Vulcan Energy Resources Ltd | VUL | $897.6 million | 67.4% |

| Latin Resources Ltd | LRS | $519 million | -35.1% |

| Wildcat Resources Ltd | WC8 | $442.4 million | -48.2% |

| Core Lithium Ltd | CXO | $235.7 million | -56% |

Sponsored brokers

Interactive Brokers

- Account minimum: $0

- Fee: Starts at $0 per trade

- Current deals: None at this time

A Nasdaq-listed broker with on-demand educational resources, an intuitive interface, and access to stocks, options, and bonds with commissions starting at $0 on U.S.-listed stocks and ETFs.

Charles Schwab

- Account minimum: $0

- Fee: Starts at $0 per trade

- Current deals: None at this time

A trusted name in online trading that offers zero-fee trading on listed stocks, ETFs, and mutual funds, with competitive interest rates on short-term money market funds.

E*Trade

- Account minimum: $0

- Fee: Starts at $0 for stocks, ETFs, and mutual funds

- Current deals: 4.25% APY on deposits, $1,000 bonus for new account signups

A Morgan Stanley-backed broker that provides a full range of investments with competitive fees, easy-to-use tools, and free market insights.

The 5 best lithium stocks to buy or watch on the ASX

After this year’s miner bloodbath, many investors are asking, “Is lithium a good investment?”

While lithium stocks have taken a hit lately, the downturn is likely temporary as the shift to cleaner energy will eventually drive lithium demand higher.

According to McKinsey, lithium demand is projected to grow by 20% annually through 2030 as electric vehicles (EVs) become a staple in the global economy.

The following five Australian lithium stocks are market leaders in terms of production, contracts, and growth potential.

Rio Tinto Ltd (ASX: RIO)

Rio Tinto is a major global mining company and one of Australia’s largest lithium producers.

In addition to lithium, the company produces iron ore, copper, aluminum, and other essential minerals, making it a key player in the global manufacturing economy.

The $100 billion mining giant is poised to be one of the biggest beneficiaries of the global transition toward clean energy.

With projects in 35 countries and 17 iron ore mines in Western Australia, Rio Tinto is well-positioned to meet the upcoming onslaught of global demand for minerals.

Even if the demand for lithium doesn’t recover as quickly as expected, Rio Tinto won’t be in much trouble.

As a diversified mining company with 1,900 global customers, Rio Tinto isn’t overly reliant on trends in the lithium battery market.

For this reason, the business can easily absorb short-term volatility.

Despite RIO’s weak stock performance this year, its business continues to grow. The company reported revenues of $54.18 billion in the 12 months ending June, a 3.3% increase year over year.

Pilbara Minerals Ltd (ASX: PLS)

Pilbara Minerals is another Australian lithium mining giant. With a market capitalization of more than $8 billion, PLS is the second-largest stock on our list.

What sets Pilbara apart is that the company operates the world’s largest independent hard-rock lithium operation located in Western Australia.

Despite reporting lower revenue and profitability in the first half of 2024 due to “a softer lithium pricing environment,” the company continues to pursue aggressive growth.

PLS is expanding into lithium chemical manufacturing in South Korea and advancing its partnership with Ganfeng for a new joint venture. (Ganfeng is China’s largest producer of lithium compounds.)

Not only that, the company unveiled a new $400 million investment to explore lithium deposits in Brazil, potentially opening up new growth opportunities in Latin America.

Mineral Resources Ltd (ASX: MIN)

Mineral Resources is one of Australia’s largest diversified resources companies, with a production pipeline that includes lithium, iron ore, energy, and other mining services.

Like other Australian lithium stocks, MIN didn’t escape the mining rout. It’s down 51% for the year, with a market capitalization of more than $7 billion.

Unlike other Australian miners, however, Mineral Resources is coming off a solid fiscal year for 2024, which ended in June.

The company’s revenues increased by 10% to $5.3 billion, driven by growth in mining services. Its production volumes rose by 9% to 269 million tonnes over the same period.

Mineral Resources also reported record lithium shipments from its Wodgina and Mt. Marion operations. After acquiring Bald Hill in November 2023, the company has shipped 67,000 tonnes.

According to the company’s latest earnings report, the only factor holding back its lithium business is the temporary decline in lithium prices.

Arcadium Lithium PLC (ASX: LTM)

Unlike most Australian miners, Arcadium is a lithium-first company.

The company focuses on the production of lithium chemicals, hard-rock mining, conventional bond-based brine extraction, and direct lithium brine extraction.

Its mission is to power the green energy revolution by supplying lithium across the entire supply chain driving the clean energy revolution.

This includes electric vehicles as well as stationary energy storage applications for rechargeable lithium-ion batteries.

In its second-quarter earnings report, Arcadium prioritized cost savings and higher production in its combined lithium hydroxide and carbonate volume.

The company expects higher output from its expansions in Argentina, Bessemer City, U.S., Zhejiang, China, and Naraha, Japan.

Despite the recent slump in commodity prices and an oversupply of lithium, Arcadium is banking on the coming wave of demand for lithium.

IGO Limited (ASX: IGO)

IGO Limited is a mining exploration company that produce critical minerals that will power clean technology, including nickel, lithium, and copper.

In 2021, the company incorporated a lithium joint venture with Tianqi Lithium Corporation, a Chinese materials company with a $7 billion market cap.

Through this joint venture, IGO has a stake in Western Australia’s Greenbushes mine, which is one of the world’s largest lithium mines.

Meanwhile, the company is actively exploring new opportunities to grow its resource base.

Although the stock has been caught in the mining stock rout, it maintains a nearly $4 billion market cap. Its exposure to major lithium mining reserves means IGO is primed to cash in on the rebound in lithium demand.

What you need to know about ASX lithium stocks

As the lightest chemical element in the alkali metal group, lithium possesses significant productive capacity for the global economy.

It is the primary metal utilized in alloys, glasses, mechanical lubricants, computers, and storage batteries.

With the highest charge-to-weight ratio, rapid charging speeds, and the ability to handle high voltages, lithium is the preferred element for rechargeable electric vehicle batteries.

These advantages often outweigh the challenges of lithium production and the associated high handling costs.

Demand for lithium has skyrocketed due to advancements in anode technologies, driven by consumers, businesses, and governments increasingly prioritizing environmental sustainability and the reduction of greenhouse gas emissions.

However, this surge in demand has also resulted in an oversupply of lithium-ion batteries, leading to downward pressure on prices.

While analysts do not anticipate a rapid rebound in lithium prices, they acknowledge that the global transition toward sustainable energy—and, consequently, the rise in lithium demand—is inevitable.

According to McKinsey, the world consumed approximately 500,000 tonnes of lithium in 2021—a figure expected to exceed 3 million tonnes by 2030.

But to capitalize on this multi-fold surge in demand, lithium producers, particularly ASX-listed stocks, must first wait out this temporary slump.

As a result, many Australian lithium producers have scaled back production, adjusted their expansion plans, and redirected resources toward other mining initiatives.

What factors affect the price of ASX lithium shares?

Globally, electric vehicle sales reached nearly 14 million in 2023—a figure expected to approach 19 million by the end of the decade, according to Statista.

Lithium-ion batteries are the go-to energy choice for EV makers due to their long life, high power-to-weight ratio, energy efficiency, and recyclability.

It’s estimated that the average electric vehicle requires roughly 8 kilograms (17.6 pounds) of lithium to operate effectively.

Lithium is favored over nickel, which has been used in electrical devices for over a century. Although nickel production is cheaper, nickel-based batteries suffer from self-discharge, generate more heat during charging, and are less reliable in extreme temperatures.

These advantages have solidified lithium's position as the rechargeable battery of choice in a global economy increasingly shifting toward electric vehicles and renewable energy.

As a result, lithium producers and mining companies ramped up production of this critical mineral.

However, after a boom between 2021 and 2022, lithium producers have had to scale back production due to slumping prices.

This market downturn has created challenges for lithium projects seeking financing to improve their development pipelines.

While Australian miners didn’t escape the global downturn in lithium prices, the country remains the world’s largest lithium producer and exporter.

This position gives ASX-listed lithium stocks (Australia) an advantage in economies of scale not found elsewhere.

Australia’s mining industry is highly diverse, providing investors with a range of options from small-cap producers to diversified miners serving multiple industries.

In times of market downturn, investing in companies with diversified portfolios of in-demand minerals, including lithium and rare earth elements, can be particularly advantageous.

Investing in Australian lithium stocks—pros and cons

As the world’s largest lithium exporter, Australia is home to some of the biggest lithium producers.

Therefore, ASX-listed mining stocks could be among the best-positioned companies to cash in on the coming boom—if for no other reason than the economies of scale.

However, as with any industry, investing in Australian lithium mining companies has advantages and disadvantages.

Advantages

- Largest lithium exporter: Australia is the world’s largest lithium producer and exporter, providing the ASX with a competitive advantage in this sector. The ASX features several diversified large-cap lithium companies alongside small-cap producers.

- Powering the green revolution: Governments, businesses, and consumers in industrialized nations are increasingly advocating for renewable energy. This transition is occurring at the consumer, enterprise, and policy levels. A sustainable future will depend heavily on lithium-ion batteries, presenting a strong value proposition for ASX lithium miners.

- Miners are undervalued: As highlighted in our list of the best Australian lithium stocks (ASX), many Australian miners are currently undervalued due to declining lithium prices. Savvy investors recognize that purchasing stocks at discounted prices is one of the best strategies for generating future returns as the market recovers.

Disadvantages

- Global competition: Although Australia hosts the world’s largest lithium mining industry, competition is intensifying from other countries, including Chile and China. The United States is also introducing incentives to encourage miners to discover and extract more lithium.

- Price volatility: The lithium industry is currently experiencing a bear market driven by falling lithium prices and a slower-than-expected demand for electric vehicles (EVs). While temporary, investors should remain mindful of the short-term volatility in lithium ASX stocks.

FAQ

What are some of the largest ASX lithium companies in Australia?

Although Rio Tinto is the largest mining company by market capitalization listed on the ASX, IGO Global operates the largest lithium mine in the Greenbushes area of Western Australia.

What is the fastest-growing lithium company?

During the most recent lithium mining boom, which ended in 2023, Pilbara Minerals' annual revenue soared to over $4 billion, with the production of lithium spodumene concentrates exceeding 725,000 metric tonnes. This makes Pilbara Minerals the fastest-growing Australian lithium miner of 2023.

Is lithium the next boom?

After a spectacular boom period between 2021 and 2022, the lithium industry has cooled in recent years. However, nations, businesses, and consumers are already laying the groundwork for the next lithium boom as they transition to a renewable energy future.

Which lithium stocks pay dividends?

Rio Tinto, Pilbara Minerals, Mineral Resources, and IGO are ASX-listed lithium miners that pay dividends. In contrast, Liontown has not paid a dividend in the last 12 months.

Where does Tesla get its lithium from?

In 2021, Tesla signed a three-year lithium supply contract with the China-based Ganfeng Lithium. Australia’s Pilbara Minerals operates a joint venture with Ganfeng.

Your email address will not be published. Required fields are markedmarked